net investment income tax 2021 proposal

The NIIT applies to you only if modified adjusted gross income MAGI exceeds. Reform of individual income tax.

How Biden S Build Back Better Hits Blue States Harder

The Build Back Better Act proposes the new net investment income NII to be 38 tax for trade or business income for taxpayers earning more than 400000 annually 500000 for married filing jointly.

. Assume his net earnings from self-employment are US208700. Net investment income tax. Net investment income tax repeal 2021.

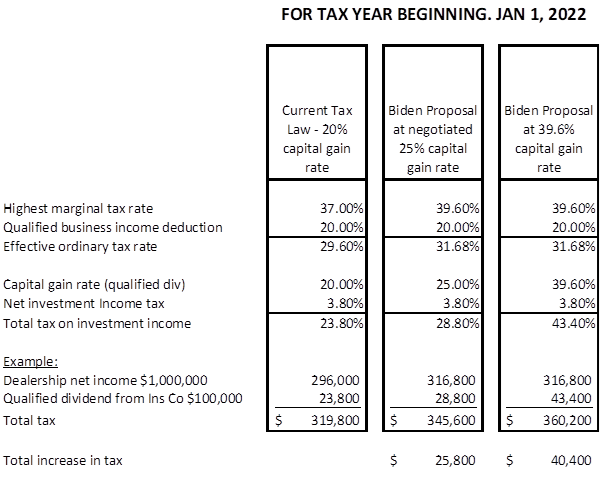

The proposal would be effective for tax years beginning after December 31 2021. The proposal would increase the top marginal individual income tax rate to 396. Fortunately there are some steps you may be able to take to reduce its impact.

This amount is 13050 in 2021. Among these is the net investment income tax that imposes a 38 percent surtax on income from investments. But in this case youll owe it on the 15000 MAGI overagesince its less than your net investment income.

One of the targets of the administration of President Joe Biden is the net investment income tax NIIT and perhaps rightfully so. For 2021 the government will raise 275 billion in revenue. This increase would be effective as of the date of the proposal ie September 13 2021.

Plan Ahead For The 38 Net Investment Income Tax Posted on July 8 2021 High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. Subject gifts and death transfers to capital gains taxes at the new rates above. In detail Expanding the Net Investment Income Tax NIIT The bill would subject individuals with taxable income in excess of 400000 500000 in the case of a joint return to the 38 NIIT on all net income or net gain from a trade or business regardless of whether the person participates in the trade or business that generated the income unless the income is subject to.

Married filing jointly 250000 Married filing separately 125000 Single or head of household 200000 or Qualifying widow er with a child 250000. Plan ahead for the 38 Net Investment Income Tax Jun 18 2021 By Dukhon Tax In Income Tax Individual Tax Tax Tips High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. In general net investment income includes but is not limited to.

A the undistributed net investment income or B the excess if any of. A special transition rule provides that the proposed maximum tax rate of 25 percent would only apply to qualified dividends and long-term capital gains realized after September 13 2021. Instead based on our reading of the latest proposal we are left with the following material changes to current tax laws.

All other threshold amounts are NOT indexed for. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax. Single individuals with modified adjusted gross incomes in excess of 200000 and married individuals filing jointly with modified adjusted.

Your MAGI overage is less than your net investment income. Interest dividends capital gains rental and royalty income and non-qualified annuities. Lets say you have 30000 in net investment income but your MAGI only goes over the threshold by 15000.

Fortunately there are some steps you may be able to take to reduce its impact. Again youll owe the 38 tax. The threshold for trusts and estates is the amount at which the top trust tax bracket takes effect.

Of particular importance for sellers the surcharge on income in excess of the applicable thresholds coupled with the expansion of the 38 net investment income tax to apply to gain from the sale of limited partnerships or S corporations could increase the tax liability on a portion of the gain recognized for transactions that close during 2022 or later by as much as. Fortunately there are some steps you may be able to take to reduce its impact. Your additional tax would be 570 038 x 15000.

Increasing marginal tax rates. For income tax purposes T can reduce his taxable income by the FEIE amount for tax year 2021 the FEIE is US108700 meaning only US100000 will be subject to income tax. Jun 20 2021 Blog Individual Taxes Taxes.

Surcharge on High Income Individuals Trusts and Estates This imposes a 3 tax on modified adjusted gross income in excess of 5000000. Net operating losses would no longer be accounted for in determining NII. Trusts are hit hard The 38 surtax kicks in at much lower income levels for trusts.

A separate proposal would first increase the top ordinary individual income tax rate to 396 434 including the net investment income tax. All About the Net Investment Income Tax. Highincome taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

Net Investment Income Tax NIIT on S Corp Profits If MAGI exceeds 500000 for a joint filer or 400000 for a single filer S Corporation profits will be subject to the 38 NIIT. The supreme court decision makes clear that the entirety of the aca is lawful and This provision is to be effective for sales occurring or dividends received on or after september 13 2021. Fortunately there are some steps you may be able to take to reduce its impact.

More specifically this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income MAGI surpasses the filing status-based thresholds the IRS. NET INVESTMENT INCOME. This expands the net investment income tax to cover net investment income derived in the ordinary course of a trade or business for high-income taxpayers.

As noted above the house tax proposal expands the Net Investment Income Tax NIIT of 38 in order to cover net investment income which is derived from a trade or business for high income taxpayers but also further imposes this. Additionally the holding period for carried interests to qualify for long-term capital gains treatment would be extended from three years to five years Expansion of the 38 Net Investment Income Tax NIIT. Can push taxpayers over the income threshold and cause investment income to be subject to the 38 surtax.

For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. Plan ahead for the 38 Net Investment Income Tax.

The NIIT applies to you only if modified adjusted gross income MAGI exceeds. This rate would apply to taxable income exceeding the 2017 top bracket threshold adjusted for inflation. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

House Democrats Tax On Corporate Income Third Highest In Oecd

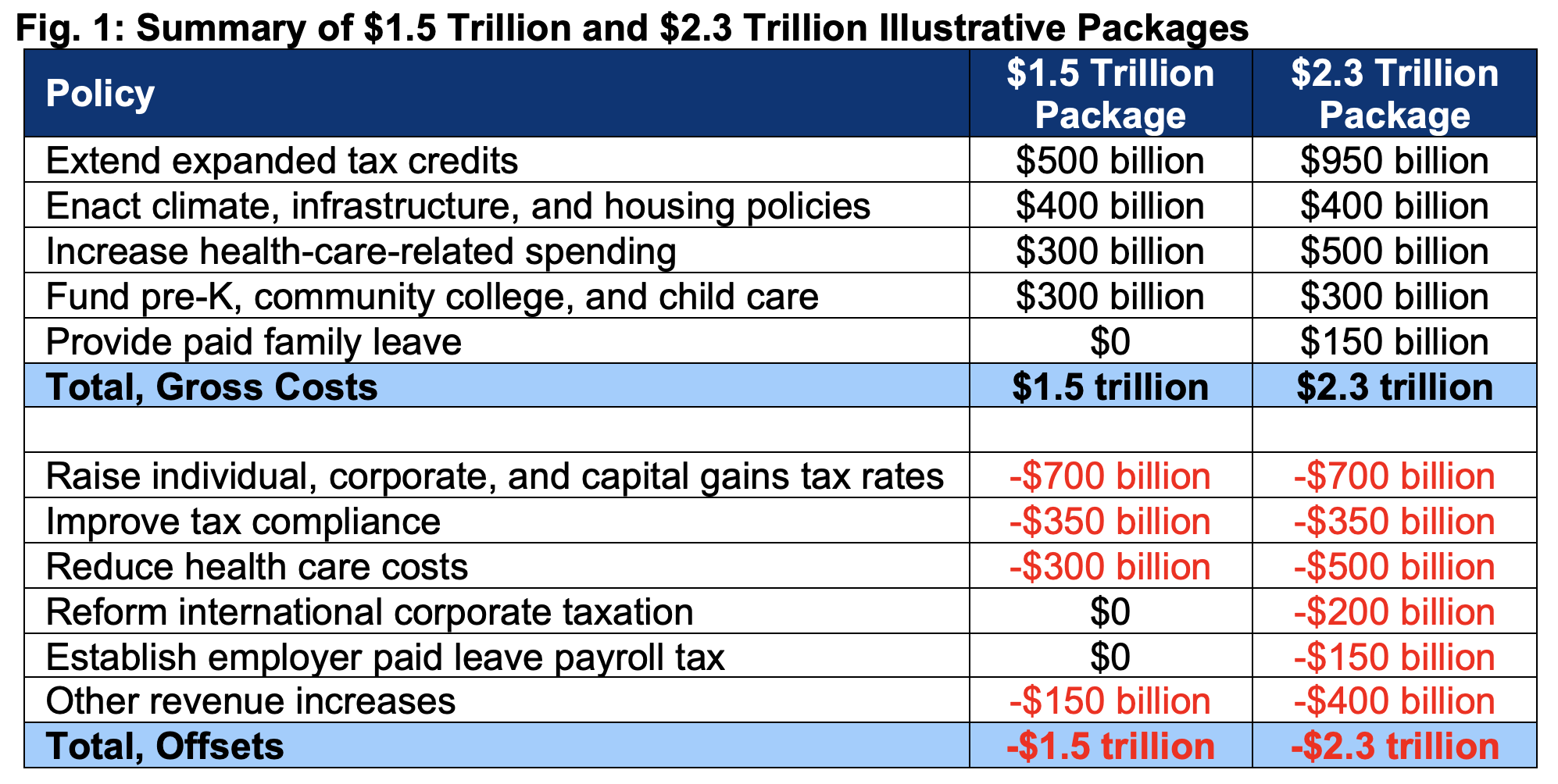

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

Biden Tax Plan And 2020 Year End Planning Opportunities

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

What Is The The Net Investment Income Tax Niit Forbes Advisor

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

What S In Biden S Capital Gains Tax Plan Smartasset

The Future Of Captive Reinsurance Companies Under The Biden Tax Plan Withum

What To Know About President Biden S Tax Proposals

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Like Kind Exchanges Of Real Property Journal Of Accountancy

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay